Best Render Farm for 2026: Reflecting on 2025 and What’s Next

Reflecting on 2025: The 3D Rendering Market and What’s Next for Best Render Farm for 2026.

As 2026 approaches, it’s the perfect moment to look back at how the 3D rendering industry has evolved throughout 2025 and what these changes mean for creators, studios, and businesses in the year ahead. From rapid market expansion to major advancements in rendering technologies, this year has laid a strong foundation for what the next generation of rendering workflows will look like. In this article, we break down key market insights, highlight the forces shaping the global 3D rendering landscape, and present our updated recommendations for the best render farm for 2026 to consider.

Table of Contents

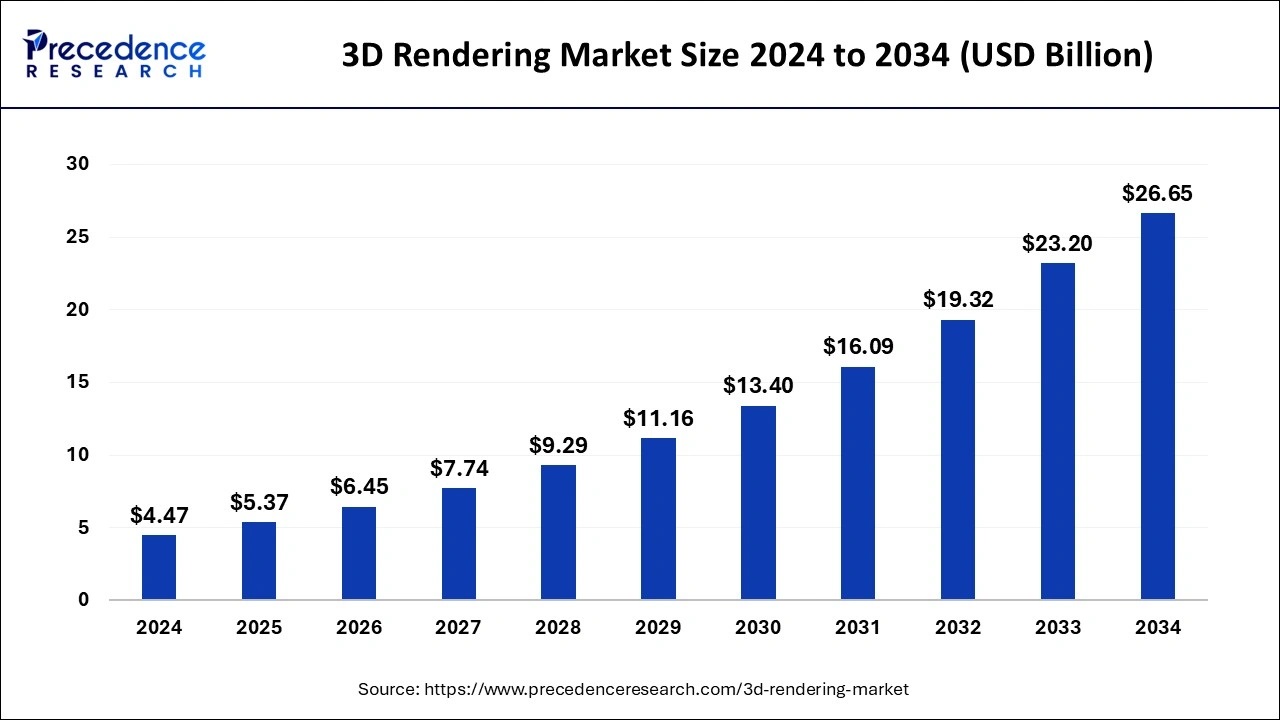

Global 3D Rendering Market Size Predictions

The global 3D rendering market was valued at USD 5.37 billion in 2025 and is projected to grow to USD 6.45 billion in 2026, ultimately reaching USD 26.65 billion by 2034. This reflects an impressive CAGR of 19.55% from 2025 to 2034.

Such accelerated growth is driven by several powerful trends reshaping how industries visualize, design, and deliver digital experiences.

Advancements in Technology

Ongoing innovation in both hardware and rendering software continues to be one of the most influential forces propelling the 3D rendering market forward. With increasingly powerful GPUs, optimized rendering cores, and enhanced algorithms, artists can now produce photorealistic results in drastically shorter timeframes. These improvements are especially meaningful in competitive fields where speed, quality, and iteration cycles are critical.

Additionally, real-time rendering has become a game-changer, particularly for gaming, virtual production, architecture, and VR/AR development. Real-time workflows are allowing teams to interact with scenes dynamically, make instant updates, and eliminate the long feedback loops traditionally associated with offline rendering. As technology continues to evolve, demand for sophisticated, high-performance rendering solutions will only increase.

Increasing Demand for Customized Products and Visual Content

Industries of all kinds are placing greater emphasis on high-quality visual content. From marketing to product design, businesses rely on compelling 3D visuals to engage customers and stand out in increasingly crowded markets. Architecture, gaming, and filmmaking remain strong drivers of 3D rendering adoption, thanks to their reliance on detailed, immersive experiences.

Beyond these fields, e-commerce has become a major growth catalyst. Online retailers now use 3D product visualization to let customers view items from every angle or see them placed in different environments, which significantly improves conversion rates and customer confidence.

Education and training sectors are also turning to 3D visualization to demonstrate complex concepts in engineering, medicine, and design. The need for interactive, intuitive content continues to expand the demand for versatile rendering tools across diverse industries.

Rising Demand for Innovative and Real-Time Rendering

Another key contributor to market growth is the rising interest in immersive technologies such as virtual reality (VR) and augmented reality (AR). These applications require highly detailed models and environments, rendered in real time, to deliver meaningful and engaging experiences.

The gaming sector, in particular, is experiencing rapid growth in VR-based content, while industries like real estate, tourism, and education are increasingly leveraging AR for interactive customer engagement. As more businesses experiment with immersive solutions, the need for high-performance rendering capabilities, both real-time and offline, will continue to surge.

3D Rendering Market Share

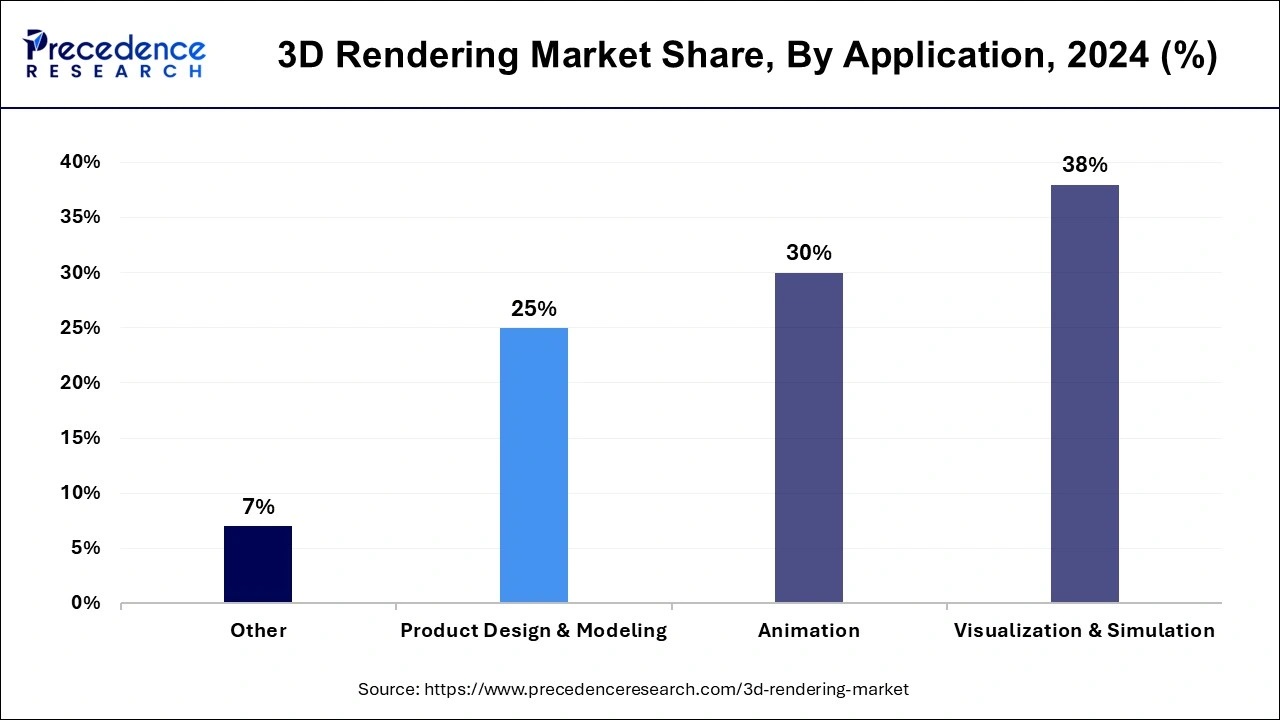

3D Rendering Market Share by Applications

Visualization and simulation remain the leading applications within the 3D rendering market. Their dominance stems from widespread use in product development, urban planning, marketing presentations, and client communication. Clear, detailed visualizations help project teams convey designs more effectively, reducing uncertainty and accelerating decision-making. Because of this, visualization tools continue to be foundational across multiple industries.

3D Rendering Market Share by Component

The software segment continues to represent the largest share of the 3D rendering market. Continuous innovation, improved usability, and the introduction of feature-rich tools have made advanced rendering software more accessible to a wide variety of users. Many leading developers are focused on enhancing scalability, integrating real-time capabilities, and introducing user-friendly features to reach broader audiences.

The cloud segment is also expanding rapidly. As digital transformation accelerates globally, more industries are adopting cloud-based solutions for their flexibility, speed, and scalability. Businesses increasingly rely on cloud rendering services to access powerful tools without investing in expensive hardware, driving significant growth in cloud-based rendering adoption.

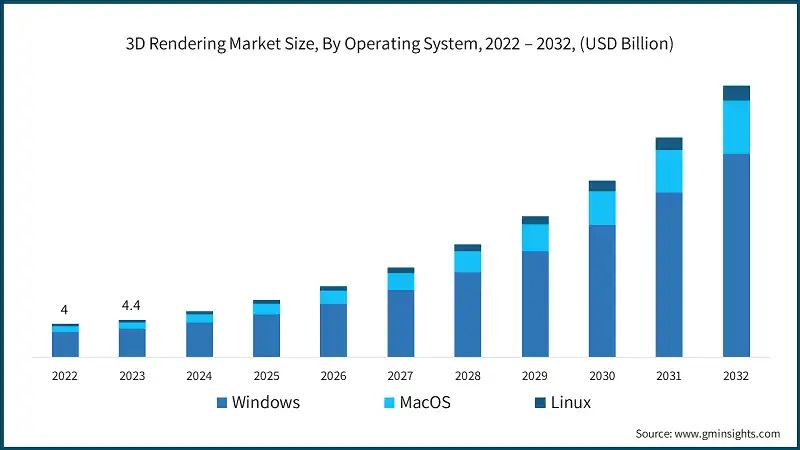

3D Rendering Market Share by Operating System

By operating system, Windows continues to lead the market with the largest share in 2025. Its popularity can be attributed to its robust graphical interface, strong compatibility with a wide range of software and hardware, frequent driver updates, and its dominance in the gaming and creative industries. Although macOS and Linux maintain loyal user communities, Windows remains the top choice for professionals working in 3D visualization.

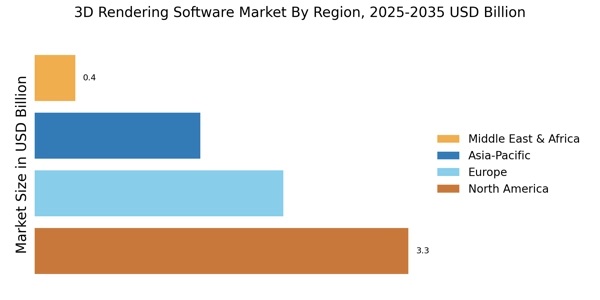

3D Rendering Market Share by Region

- North America leads the global market, holding roughly 45% of the total share. Its strong performance is driven by technological innovation and high demand for quality visual content across gaming, film, architecture, and virtual production.

- Europe holds around 30%, bolstered by a deep-rooted focus on design, creativity, and engineering, especially in industries like automotive, architecture, and entertainment.

- Asia-Pacific accounts for approximately 20% and is experiencing the fastest growth. This surge is fueled by rising investments in gaming, VR/AR, and architectural visualization as countries in the region expand their technological capabilities.

- Middle East and Africa (MEA) hold about 5%, with increasing adoption of rendering technologies in real estate, entertainment, and large-scale infrastructure projects, particularly in regions such as the UAE and South Africa.

Key Players in the 3D Rendering Market

The 3D rendering landscape is shaped by a group of highly influential companies known for their technological innovation and comprehensive solutions. These industry leaders consistently introduce new features, rendering engines, and workflow improvements to support professionals across architecture, gaming, design, manufacturing, and entertainment.

Major players include:

- Adobe (Adobe Dimension, Substance 3D)

- Autodesk Inc. (3ds Max, Maya, Arnold)

- Chaos Software (V-Ray, Corona Renderer)

- Dassault Systèmes (SOLIDWORKS)

- Epic Games (Unreal Engine, Twinmotion)

- Lumion (Lumion)

- Maxon (Cinema 4D, Redshift)

- NVIDIA (Omniverse, Iray)

- SideFX (Houdini)

- Unity Technologies (Unity Engine)

These companies continue to set industry standards for quality, performance, and innovation.

Render Farms in the 3D Rendering Market

The growing demand for high-quality visual content across multiple industries has significantly increased reliance on render farms or specialized rendering services that provide the computing power required for large-scale projects. Entertainment studios, architectural firms, advertising agencies, and game developers often depend on these services to meet their deadlines without overwhelming local hardware.

Compared to in-house rendering, render farms offer key advantages:

- Access to cutting-edge hardware and software, which many organizations cannot cost-effectively maintain themselves

- Expert assistance for optimizing render pipelines

- Flexible scalability for projects of any size

- Fast turnaround times, even for complex scenes

- Reduced infrastructure costs by eliminating the need for expensive servers and maintenance

Despite rapid growth in the broader industry, no major new render farms have entered the market in the past 2–3 years. Instead, the market continues to be led by long-standing, reliable companies with proven infrastructure and expertise. These established providers remain the top choice for professional rendering needs.

Any Restraints for Render Farm?

Integration of AI and Machine Learning

Artificial intelligence and machine learning have started to reshape the rendering ecosystem. These technologies are being integrated into rendering engines and text-to-image tools to boost speed, improve denoising, enhance materials, and generate high-quality visuals with lower computational requirements. While this presents exciting opportunities, it also prompts render farms to evolve their offerings to remain competitive.

The Launch of Render Farms by Big Names

In August 2025, Autodesk announced a new cloud-based rendering service designed to streamline workflows for architects and engineers. This move signals Autodesk’s intention to expand its presence in cloud rendering, strengthen real-time collaboration, and capture more of the growing demand for cloud-powered design tools. Such a development could reshape market competition in the coming years.

Risk of Unlicensed Software Usage

Software piracy remains a serious challenge for the 3D rendering market. Unauthorized installations contribute to financial losses for developers and undermine software reliability. According to the Software Alliance (BSA), more than 1,500 cases of unlicensed software usage were reported, highlighting ongoing risks. However, increased investment in research, security measures, and licensing protections is helping companies address these concerns and safeguard the industry’s growth.

Best Render Farm for 2026 Recommendations

Each of the best render farm for 2026 offers unique strengths, ensuring that 3D artists, designers, and studios can find a solution tailored to their needs, whether they prioritize GPU acceleration, seamless integration, or cost efficiency.

iRender Farm

iRender is one of the best render farm for 2026, which is a cloud rendering service from Vietnam, established in 2019. Of all the render farms in the list, its approach and development are really impressive.

The platform of iRender is IaaS, which means you can control and use their remote servers as your own computer. Therefore, you can install any software and renderers.

- CPU: AMD Ryzen™ Threadripper™ PRO 3955WX, AMD Ryzen™ Threadripper™ PRO 5975WX

- GPU: 1/2/4/6/8 x Nvidia RTX 4090

- RAM: 256 GB

- Storage (NVMe SSD): 2TB

- Price: $8.2 – $52 per node per hour

- Supported software: Cinema 4D, 3ds Max, Maya, Houdini, Redshift, Octane, Blender, V-Ray, Unreal Engine, Arnold, Iray, Omniverse, Keyshot, Twinmotion, Lumion, Enscape, D5 Render, and more.

- Discount and promotion: Bonus for new users, volume discount, education discount, seasonal sale, and referral program.

GarageFarm

Garage is a cloud rendering service from the United Kingdom, which has a history of 12 years in this industry. It’s also a SaaS render farm with their own app to help you work with their farm directly from your own desk. You can download their app renderBeamer to upload and render your jobs.

- CPU: Intel Xeon v4 22/44/88 physical cores, AMD Epyc 3rdgen 32 physical cores

- GPU: 1/2 x Nvidia RTX A5000, 4/8 x Nvidia P100, 1x Nvidia L40s

- RAM: 60/70/86/120/140/240 GB

- Price: From $0.015 per GHz hour for CPU rendering; From $0.0025 per OB hour for GPU rendering.

- Supported software: 3ds Max, Maya, Cinema 4D, SketchUp, Blender, V-Ray, Corona, Arnold, Redshift, Cycles 4D, ProRender, Vue, Lightwave, Modo, Rhinoceros3D, Terragen, and plugins.

- Discount and promotion: Free trial, volume discount, and a 33% discount for Blender rendering.

RebusFarm

Rebus is a company in Germany that provides high-performance 3d rendering services. It has more than 15 years of experience in the field of 3D rendering and has earned the trust of many big studios and companies. They provide a SaaS platform. They develop tools called Rebusdrop, which can be added to your own software, and you can just render from your software.

- CPU: AMD’s Threadripper 3970X, Intel i9-7980XE

- GPU: NVIDIA’s Quadro RTX 6000

- RAM: 64/128 GB

- Price: From 1.28 cents per GHz hour for CPU rendering; From 0.48 cents (+ 0.10/0.21 cents) per OB hour for GPU rendering.

- Supported software: 3ds Max, Cinema 4D, Maya, Blender, V-Ray, Corona, Redshift, Octane, Mental Ray, Maxwell, Modo, Softimage, Lightwave, SketchUp, Rhino 3D, Arnold, and plugins.

- Discount and promotion: Free trial, volume discount, education discount, and seasonal sale.

Ranch Computing

Ranch is a company in France that provides high-performance 3d rendering services. It’s a well-established farm that has a long history of 15 years in this industry. They provide a SaaS platform, with a plugin integrated to your 3d software called RANCHecker and a plugin called RANCHSync to synchronize your data. It will help you to check if your project is okay and upload/download your project. If it’s okay, it will upload through RANCHecker. Then it’s their job to render for you and notify you when it’s done, and you can download the results from RANCHSync.

- CPU: AMD Epyc 7763, Dual Xeon E5-2697A v4, Dual Xeon E5-2690 v2

- GPU: 1-4 NVIDIA GeForce RTX 2080 Ti/3090/4090/5090

- RAM: 128/256 GB

- Price: From €0.011 to €0.016 per GHz per hour for CPU rendering; From €0.005 to €0.01 per OB per hour for GPU rendering.

- Supported software: 3ds Max, Cinema 4D, Blender, Maya, Houdini, Maxwell, Indigo, Octane, Arnold, V-Ray, Redshift, Corona, FStorm, RenderMan, and plugins.

- Discount and promotion: Free trial, volume discount, education discount, and seasonal sale.

Fox Renderfarm

Fox Renderfarm is from China, established in 2009. It’s a well-known cloud rendering service that is the choice of many 3D artists, and is the service for many hits and blockbusters. The approach is still SaaS, but you will proceed with the render on their website.

- CPU: 20/24/36 physical cores CPU

- GPU: 2x Nvidia GTX 1080Ti, RTX 2080Ti/3090/4090/4090D

- RAM: 64/128/256 GB

- Price: From $0.0306 to $0.051 per core per hour for CPU rendering; From $0.9 to $1.8 per node per hour for GPU rendering

- Supported software: 3ds Max, Maya, Cinema 4D, Blender, Unreal Engine, Houdini, Arnold, V-Ray, Redshift, Corona, Octane, RenderMan, and plugins.

- Discount and promotion: Free trial, user level discounts, education discounts, seasonal sale, and referral program.

Final Thoughts

The global 3D rendering market shows no signs of slowing down. Continued advances in hardware, software, AI-driven workflows, immersive technologies, and cloud-based solutions are fueling stronger adoption across industries. As businesses increasingly prioritize visual quality, interactive experiences, and consumer engagement, demand for high-performance rendering will keep rising.

In this expanding landscape, many professionals will continue to rely on cloud render farms to handle large, complex projects efficiently. Our recommended best render farm for 2026 are:

- iRender Farm

- GarageFarm

- RebusFarm

- Ranch Computing

- Fox Renderfarm

These long-established providers have consistently demonstrated reliability, performance, and cost-efficiency, which makes them excellent choices for creators entering a new year of ambitious 3D projects.

See more:

No comments